We need guarantors in the professional world when two parties want to sign an agreement with each other or want to get into a business relationship but fail to trust each other. With their consensus, a person who both parties trust is convinced to become the guarantor. However, it is essential that the guarantor also trust both of them, as it is a big responsibility to give a guarantee on behalf of someone.

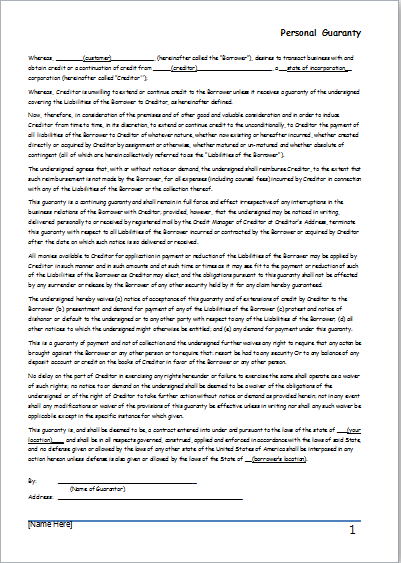

What is a personal guarantee form?

It is a document used by a guarantor who agrees that he will take responsibility for the debt that is to be paid by the debtor. The guarantor is consulted when the lender has a fear that the borrower will not be able to pay the amount he is borrowing. So, the guarantor plays a role in helping both parties strike a deal with each other.

Through this form, the guarantor also makes sure that both parties are in a position to fulfill the financial obligation and that they will not run away because if the borrower refuses to pay, the guarantor has to pay on his own.

When should I use the personal guarantee form?

This form can be used in different types of situations, particularly when a financial transaction is being carried out between two parties. Some common financial transactions in which the guarantee form is used include loans, business agreements, leases, etc. Those who have low credit scores often fail to convince other people to trust them. They need a guarantor, and therefore, they are more likely to use this form. The form is used whenever people want to achieve a sense of security and safety.

What information is provided by the guarantor form?

The form basically collects the following details from the user:

Details of the parties involved in the transaction

There are numerous empty fields that are intended to collect information about the parties that are involved in the transaction or the agreement. The details of the guarantor are also included in the form.

Details regarding the obligation

All the parties involved in the agreement usually have some obligations to fulfill. These obligations are written down, and then people sign them to confirm that they are ready to abide by what has been written in the agreement.

The obligations that are mentioned include the loan amount that will be paid back, the terms and conditions of the lease agreement, conditions regarding how everything will take place and how the performance will be kept at a certain level, and much more depending on the type of agreement.

Liability of the guarantor

In a financial transaction, the guarantor does not agree to pay the total amount that the debtor is supposed to pay. Rather, he promises to pay a percentage of it. In simple words, it shows the maximum liability of the guarantor. This section of the form secures the guarantor and his rights, and he can protect himself from any sort of dispute later on.

Signatures

There is a section of the form where the signatures of the parties involved, including the guarantor, are taken. Once the signatures have been taken, the form becomes a legal document that can be challenged in court.

Details of the witness

In some cases, the parties involved in the agreement want to have a witness who can vouch for having witnessed everyone agreeing on the agreed-upon terms and conditions, and due to this, no one in the agreement can claim to have been coerced. Although you can also go without this section, it makes the form more professional and adds a layer of security to the contract.

The final take

While filling out this form, the guarantor must understand that there are always risks involved in an agreement. Therefore, he should be very careful when taking responsibility for someone’s actions. In addition, the guarantor is always advised to read the obligations and assess the risks before signing and agreeing to be a guarantor.

Legal advice can also be sought in case the guarantor does not understand something about a contract. Those who are creating this form should also make sure that it shows compliance with the rules and regulations of the state where it is going to be used.