An organization needs to analyze its performance to determine if it is working appropriately or if it needs to change a few of its operations. Companies usually review their budget on a monthly, quarterly, and yearly basis because it is not possible to review the budget more frequently than that. Changes usually occur in large quantities, and they become visible usually in the first quarter or half year. So, it would be convenient for you if you analyzed the budget of your company every 4 months.

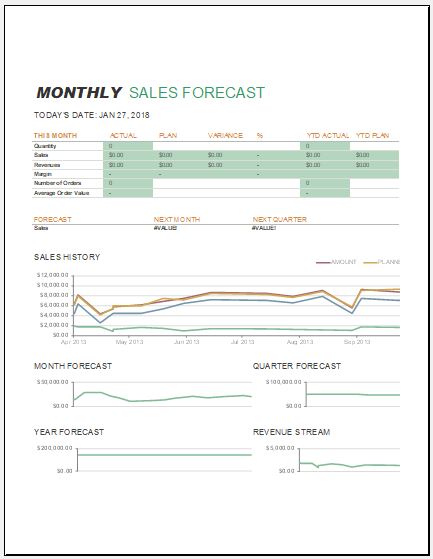

What is a quarterly budget analysis sheet?

It is a tool that is used to help people perform the analysis with little effort. It usually helps people take note of the budget amount and the actual amount and compare the two to see the variance and all other financial factors that are necessary for an organization to control its expenses and budget.

What should you include in the four months of budget analysis tools?

The budget review tool works tremendously because it makes your life easy and also helps you in the process of decision-making. However, all the benefits can be reaped only when you know what details this sheet should be able to collect.

Here are some basic elements of the 4-month review sheet for the budget:

Year and quarter details:

At the top of this sheet, you should mention which year and which quarter of the year this sheet is targeting. There are four quarters in a year, and you can specify each of them by mentioning their month name or naming them based on the sequence. Since you will have to create a report and use this sheet every 4 months, it is important to keep one sheet distinct from another. This is possible only when you mention the name of the year and quarter number.

The amount you have planned to spend:

To spend money wisely, every company has its own specific budgeted amount that it wants to spend. The budgeted amount is generally found by carefully considering all the expenses and then allocating a specific amount to them.

For this purpose, it is recommended that you divide all your expenses into difficult categories, and then it will be easy for you to allocate a specific amount to each of your expenses. Some common categories include utilities, transportation, savings, etc.

Actual expenses:

As you keep spending money, the actual cost of things starts to emerge, and you realize there are different rates from what you expected. Due to this, the actual amount that you have spent is always more or less different from the budgeted amount.

The actual amount also lets you see the variance, and based on this, you can make various decisions. For instance, if it turns out that the real amount that you have spent is far more than the projected amount and it has put your business at a loss, you can make several decisions that can help you cut out on various expenditures to fill the gap.

Variance analysis:

There is a unique section on this sheet that is used to perform variance analysis. The variance analysis enables you to carefully see the difference between the actual and projected amounts and determine to what extent these amounts differ from each other.

This section of the sheet is very critical because it enables you to get a deeper insight into how everything about finance management works and how to manage your finances efficiently.

Variance analysis is a key factor in assessing and evaluating the budget for the entire quarter. The variance of different quarters can also be compared to determine fruitful results.

A section for comments:

There is a section in the sheet that people create deliberately, especially when they want to take notes of several important points that they think they might forget. These comments or notes are also important for other people who try to understand the analysis done by you if you are not present to make them understand. The comments section is very useful, and one should try to make the best use of it.