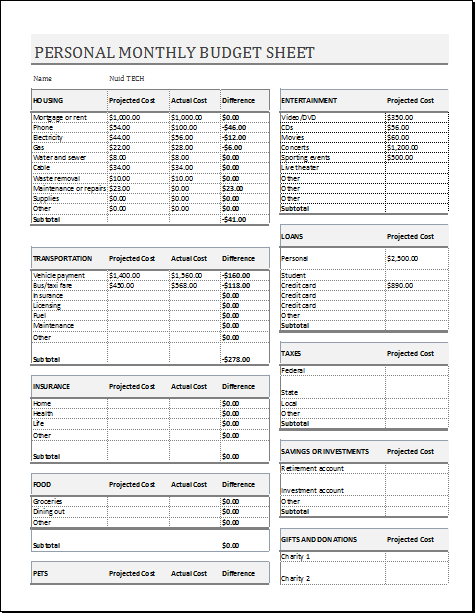

If you want to control your expenses and make a budget for all the expenses in your personal life, you will find a personal monthly budget sheet a very useful tool for you. This is an MS Excel sheet that has been designed in such a way that it can help all people manage their finances.

People usually like to budget every month since it is often a time-consuming task and they don’t want to waste so much time on it.

How does a personal monthly budget sheet work?

A personal monthly financial control sheet is for all those people who are aware of their uncontrolled spending habits and know that they are unable to save money. People with limited income and unlimited expenses can also use this sheet. It is helpful in budgeting as it enables people to see how much they are spending. This keeps them aware of their expenses, and they develop an understanding of how to control them.

People who want to manage their expenses and get themselves together find this tool very helpful. It helps them get an overview of their finances, which lets them see where they stand and how much budgeting they need to do every month.

Some people set a goal of saving up a specific amount each month to meet that goal. This tool is best for them, as it helps them reconsider what they can do to reach their goals without going broke.

What information should be provided on a personal monthly budget sheet?

This sheet will be helpful for you only if you can input all the information correctly into it. It usually gathers information, including:

Income of the person:

The budget sheet should know how much you are earning each month because its results and deductions will largely depend on it. You should mention your total income here. It should include income in total, no matter from how many sources it comes. You should not forget to mention your passive income as well. In other words, the inflow of cash into your bank account should be recorded on this sheet.

Expenses:

The sheet will allow you to mention the total amount that you are willing to spend on various things. This section often breaks down your expenses into sub-expenses, and then you can mention the amount you are spending on various areas of life, including utility bills, mortgage installments, fuel expenses, groceries, and whatnot. Since you have not incurred these expenses yet, what you are writing down on this sheet is your guess, and the real amount might be different from it.

Saving goals:

Here, you will have to mention what percentage of your total income you want to keep aside as savings. This sheet will let you see how much you are required to control your expenses to meet your savings goals. In some cases, you only struggle to make ends meet. In this situation, too, this sheet will tell you how you can do it.

Using a template:

If you are serious about controlling your expenses, this sheet is definitely for you. You can also get the template of the sheet from various sources. The template is usually a ready-made sheet in which the user is just required to input and fill up the empty fields. Once you do it, it shows you the results.

You can download it and keep it on your mobile phone so that you can access it from anywhere. In addition, you can note down your expenses at the very moment because you might forget about them later.

Using this template will help you stay organized in terms of spending your money. You can always monitor your spending, and this way, you will have strong willpower to spend too much unnecessarily. If some unneeded expenses do nothing but satisfy your desire of any sort, you can think of putting them off for some time so that you can be financially strong and shine again when you become financially strong.