Making and planning a budget is one of the major concerns of people, especially those who are struggling with the management of their expenses. All they do is make a sheet in which they input the details about the budget and their expenses. In the business world, there are different periods of budgeting that are planned, and then it is seen how much has been spent and how much to control.

What is an 18-period budget template?

This is a tool that is used to determine the budget of an organization over 18 periods. The length of the period may vary depending on the specific needs of the company. Some companies have a period of one month while others have slightly longer or shorter periods. How a company wants to plan its budget and what amount it wants to save entirely depends on the individual needs of the company and not on the template.

The template does not require any business to allocate a specific amount to the budget. Rather, it is the financial situation that defines how much budget to allocate and what to see while noting it down using a template.

This template can serve as a great tool for those who wish to maintain the money in their account and control their expenses but don’t have any idea where to start. In other words, people can get a very concrete and solid starting point when they get their hands on the template and start using it. However, it is important to make sure that it is used as per the needs of the company and that it meets the needs of the business.

What does a template for a period budget include?

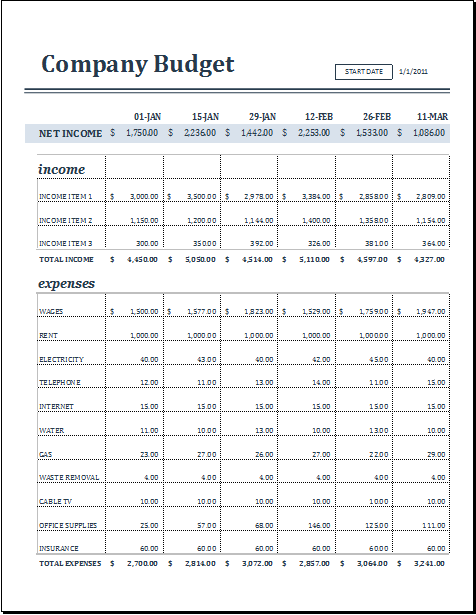

It depends on the business as to what details it needs for planning the budget and executing that plan. A commonly used period budget includes the following details:

Period number:

There are 18 rows in this template and each of them mentions details regarding one period. This way, it becomes easy for the business owner to focus individually on each and every period. While using this template, you can easily see the long list of 18 periods and their corresponding details in front of them.

Income:

This column of the template mentions the income generated by a business in a specific period. Here, the income is mentioned in the numerical value and the name or sign of the currency in which the income is being noted is mentioned in the heading of the income column.

Expenses:

To manage the financial situation and prevent it from going too far, one needs to understand and get complete insight into expenses. Here, you will have to take all the items and services that you have purchased and spent money on. In the end, total out all the money and write the sum amount here on the sheet.

Savings:

Another critical aspect of the period budget is the amount that a business has managed to save. This is usually calculated by subtracting all types of expenses from the total income, and then the remaining amount is taken down in the section of the savings that shows the amount that the business has saved over the period of 18 months or weeks.

Comments:

There is a last section in the sheet where comments can be noted in front of each period. These comments are not mandatory. However, they are used to conclude the entire period.

How is the template beneficial?

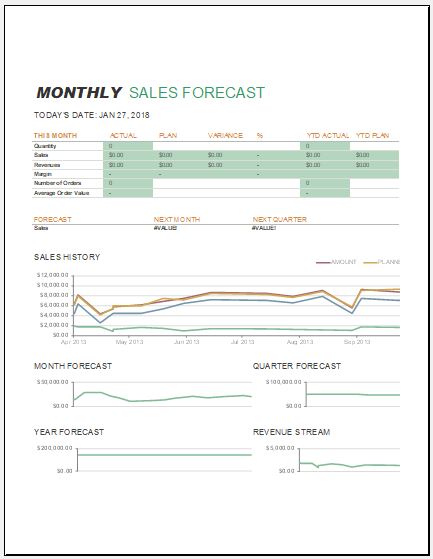

The template is very useful for those who want to keep track of their budget over 18 periods. This is useful for businesses that want to keep an eye on the progress they make in terms of saving money or making income. When the data from 18 periods is in front of you, you can easily compare the current data with the history of the data, which will help you see and forecast trends in the future.

A lot of business decisions are based on the results obtained from the forecast, and this leads to many benefits as a business can be able to spend its money more wisely.