#1

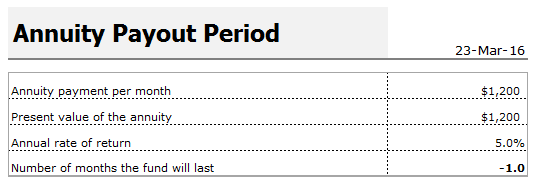

Annuity Payout Calculator

The term annuity means an investment that provides many payments in exchange for an initial lump sum. By definition, the word annuity refers to any terminating stream of fixed payments over a specified period of time. For example, the amount you pay monthly as your home mortgage payment and regular deposits to your savings account. An annuity calculator is a device that is used to calculate annuity payout. With an annuity payout calculator you can perform several tasks in the form of calculations; such as:

- You can find out the payment that would deplete the fund in a given number of years.

- The amount needed to generate a specific payment can be calculated.

You can calculate the number of years; your investment would generate payments at your specified return.

File 456 KB

#2

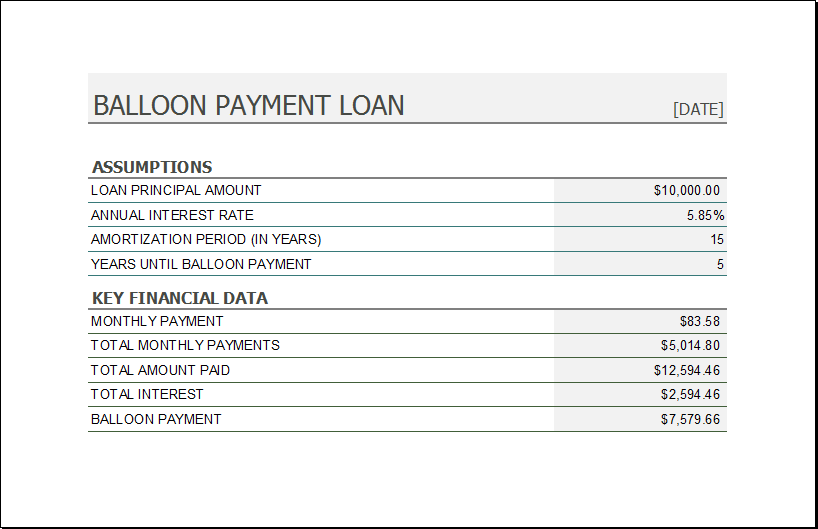

Balloon Loan Payment Calculator

Many online calculators help you in calculating balloon payments, loans, or interest costs with any balloon loan terms. A balloon loan is better than others as it may be taking a lower interest rate. Balloon loan payments are usually paid when your loan time period ends and you have no balance and all payments were already paid.

But a loan still has a balance remaining it is called a loan with a balloon payment. The main reason to choose the balloon loan is that it is easier than a conventional loan and is low in interest rate. A balloon mortgage payment is an outstanding option for a house buyer who wants to buy a home.

This is dependent on you that how much you can borrow and pay back. Balloon loan payments are really affordable and help you with the risk factors of the loan. You can also convert this loan into a traditional loan.

File 456 KB

#3

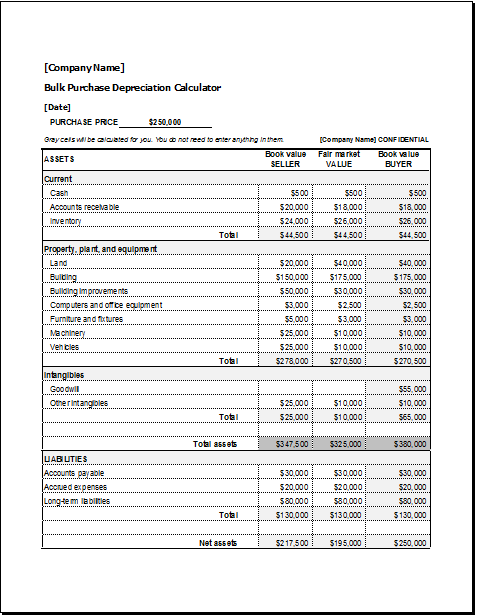

Bulk Purchase Depreciation Calculator

The Bulk purchase depreciation calculator is used to calculate depreciation on your bulk purchases.

The term depreciation means a reduction in the value of an asset due to wear and tear or usage. After utilizing an asset for some time its value decreases as it becomes old and used. Bulk purchase means buying assets in large quantities. To calculate the bulk purchase depreciation of assets you can visit so many online sites and calculate your bulk purchase depreciation.

- The one evident advantage of calculating depreciation on your bulk purchases is that you can have an estimate of the value of your assets in the future.

- For companies buying assets in bulk quantities might need to sell them and the calculator can give them an insight into the amount they could get after selling.

File 456 KB

#4

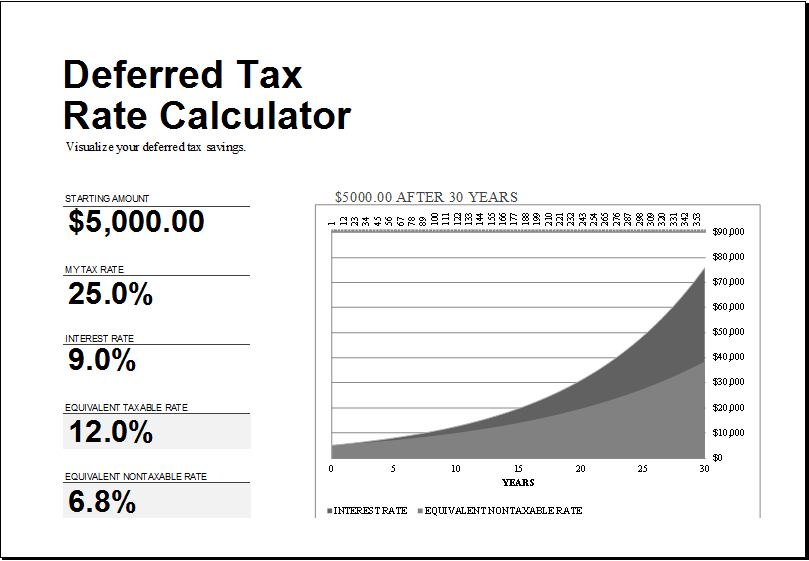

Deferred Tax Rate Calculator

As the word deferred suggests it is such an item usually money that is delayed in an organization’s account. The amount deferred can be of both kinds either it has to be paid by the company or the company has to receive the payment. As everything has its pros and cons same is associated with deferred tax rates and are mentioned below.

Advantages

One can meet with certain advantages regarding deferred tax rates. The interest rates applied to such an item are usually less as compared with usual rates. The tax that is to be charged on income is usually added under deferred accounts.

Such an account adds a lot to the employees planning to shift their organization as the process can be accomplished without involving any tax deduction.

File 456 KB

#5

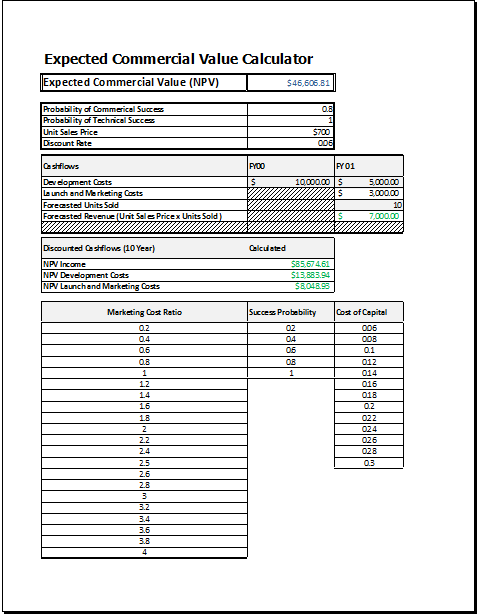

Expected Commercial Value Calculator

A company may need to maximize the commercial appeal value while working and staying within the limits of the available budget. In this case, the company is said to be calculating the expected commercial value. In some cases, it becomes very important for the company to figure out the value of expected value using a calculator.

The expected commercial value calculator is not alone a decision-making tool but it also helps in finding the expected commercial value. The expected commercial value calculator is a very valuable tool and accelerates the process of calculation. A quick estimate of the commercial viability of the project is provided by this calculator. To calculate the expected commercial value, you are required to have a very simple formula.

File 456 KB

#6

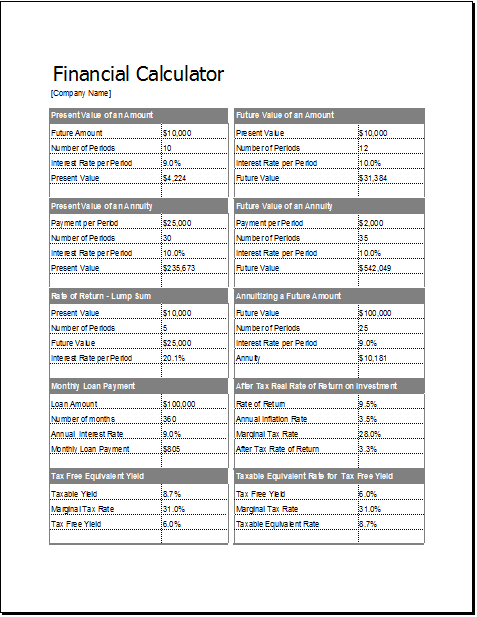

Basic Financial Calculator

A financial calculator is also called a business calculator. It is an electronic modern calculator which is smart enough to perform all financial functions which are needed to be performed commonly in the business and the e-commerce world. The calculator contains many standalone keys for different financial and commercial uses.

The financial calculator has been made very modern and intelligent so that it can solve all the problems related to finance. Many user-programmable financial calculators also come on the market which allows the user to add more functionality to the calculator when required. It can be a very useful tool for those people who are working in the finance industry. Such people use financial calculators as a necessity, not as a luxury.

File 456 KB

#7

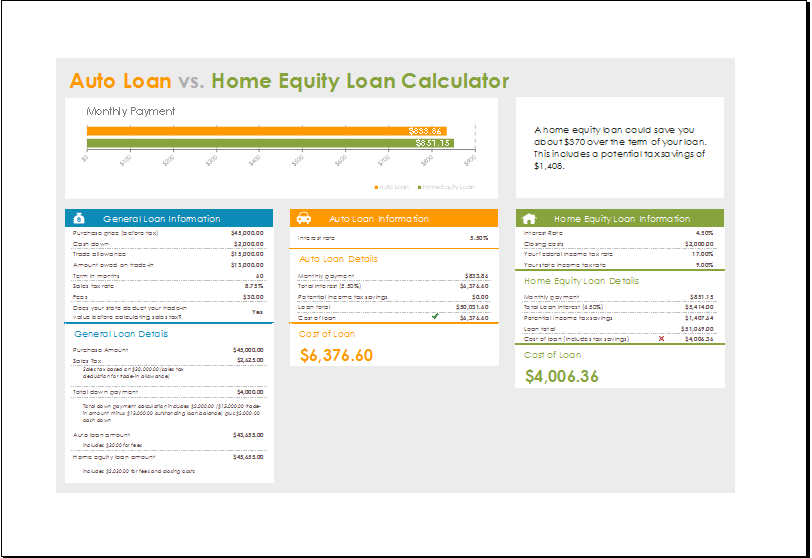

Home Equity Loan Calculator

You can calculate the home equity rate and the partial information that you will determine with the help of the amount which you want to borrow from anyone. This is a very easy-to-use calculator which can help the person in calculating the monthly payment for themselves.

You can give the figures to the calculator to calculate them. The calculations which are made by the home equity loan calculator are totally dependent on the values you provide to it. It calculates every value very precisely. This calculator is very easy to use and you can find it on many websites. The main purpose of using this calculator is to find the estimated amount of a loan in a very short time.

File 986 KB

#8

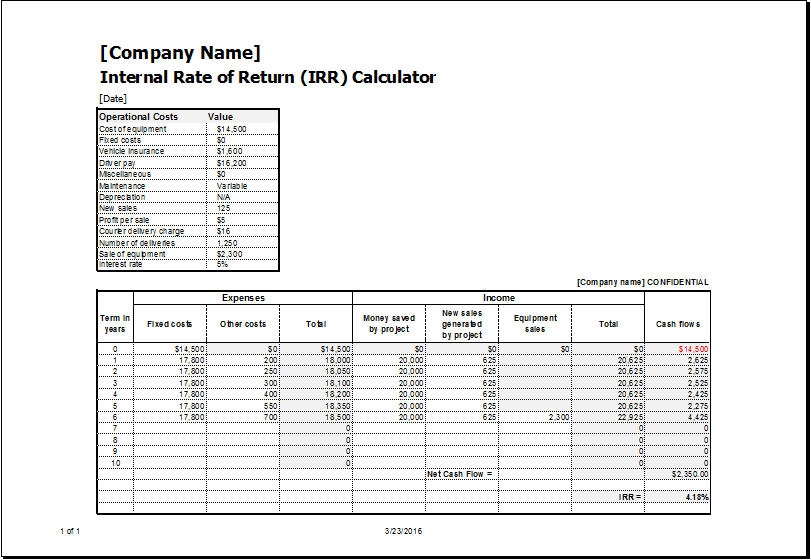

Internal Rate of Return (IRR) calculator

This calculator helps you in deciding which project is best for giving the way of greatest return investment per dollar. IRR is used to get the net present worth zero. The IRR is the interest rate and discount rates also. The interest rate gives you the present value of your investment or cash outflow.

IRR is utilized to estimate the magnetism of a project or investment. If you have got a top IRR than your company’s required rate of return then you should go with the project it is desirable for you. And if the internal rate of return falls down to the required rate then you should refuse the project.

IRR is best for examining business enterprise assets and personal equity investments.

File 986 KB

#9

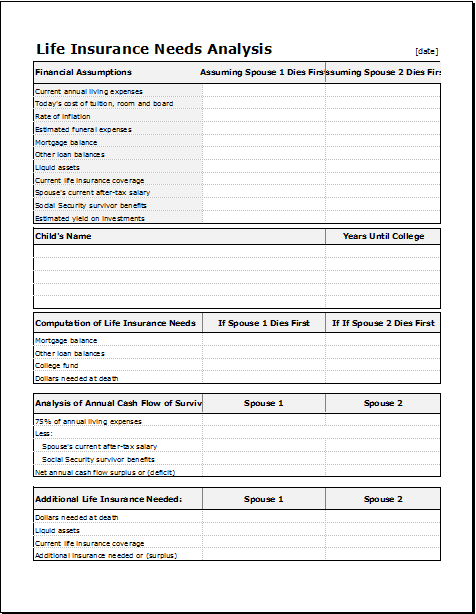

Life Insurance Needs Calculator

Life insurance makes your life easy and planning for your financial needs is the main reason for getting insurance. You must have to create the best financial plan for your family and your needs. But you have to be sure that after your death your family will continue to meet all the requirements of your insurance.

This calculator helps you in analyzing the finical requirements and it stood on the information you have given concerning your aims and hopes. Your given details help out the calculator for giving details about how much you need insurance for death, permanent disablement, and income protection.

Accuracy is the first part of this insurance calculator and which data you have to provide the calculator it’s just used in the calculating.

File 986 KB

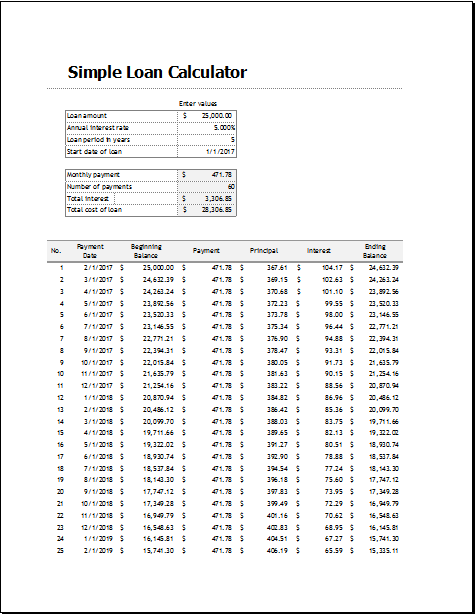

#10

Loan Calculator

Many people get a loan from banks for buying cars, for spent vacations, and for getting a home extension. A loan calculator is good for balancing the rate of interest on a loan which makes it easy for customers. This will help you to decide on the monthly payments on your loan. You just get by entering the loan amount, terms, and interest rate and get the calculation of your loan. This calculator can be used for advance, car, or any other fixed loan kinds.

With the help of a loan calculator, you can calculate loan repayments. You can figure out the repayments of the secured or unsecured loan with the help of a breakdown calculator. This calculator also helps you work out how long it will take to pay off your loan and it is based on the costs you are at present making.

File 986 KB

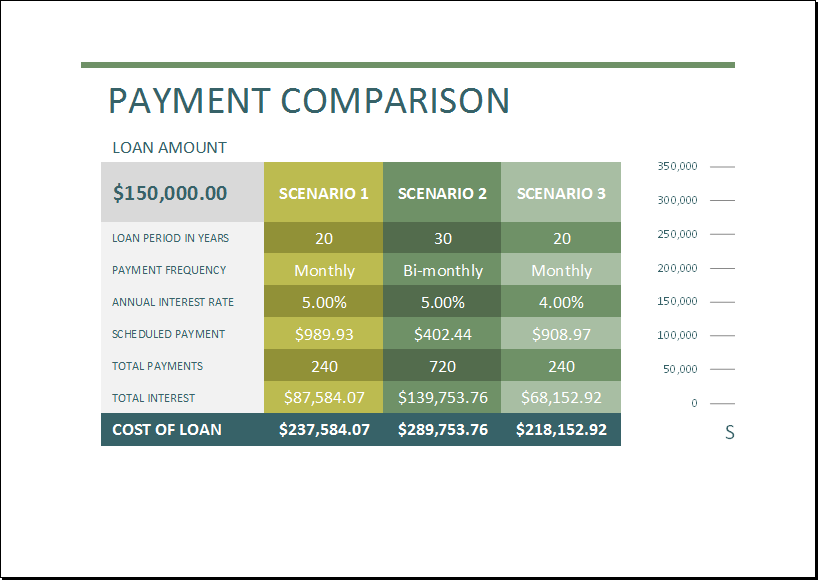

#11

Loan Comparison Calculator

You can compare the monthly payments to determine which type of loan provides the best value to you. Monthly payments, fees, and other costs associated with loans can be sorted out with the help of a loan comparison calculator. The best functionality which is provided by this calculator is the calculation of multiple loans side by side at one time. This enables the person to get a loan that can benefit him in the best possible way.

All you have to do is to enter the amount on the loan, the rate of interest, and the term of each loan in the calculator and you will get the required payment amount. It also facilitates you by allowing you to add any principal amount in the calculator for calculation.

File 986 KB

#12

Sales Commission Calculator

Sales commission or simply commission is the amount that is paid to the broker or financial agent on account of negotiating a sale. This commission is usually a percent amount of the selling price. This percentage amount is called the commission rate or commission percentage

One can calculate the sales commission amounts either by manual calculation or by using some online sales commission calculator tool. The basic formula to calculate it is to multiply the sales amount by that of the commission percentage.

The sales commission calculator also works on this formula. The advantage of using this calculator is that firstly it saves your time from the long and detailed calculations, secondly, it provides accurate results if you input the exact values. You just need to enter the value of your sales amount and commission rate, then this calculator will calculate your commission instantly.

#13

Payroll Calculator

A payroll calculator is used for the estimation of your salaries and you can calculate the federal and provincial payroll deductions. This deduction is included in your official statements on salary. The consistency is dependable on the precision of information that you have provided to a calculator. You just enter your payment information and get the numbers that explain to you how much to give and what to subtract from taxes.

This is a simple method to check bonuses or commissions which you have gained. You can select hourly paychecks or salary paychecks and check deductions on your salaries. This calculator helps you in balancing your spreadsheet for salaries.

Hourly paychecks calculators are estimated your net pay salary for hourly workers after balancing taxes or deductions. And salary paychecks calculators are used for the estimation of net pay for salaried after the deduction or taxes.

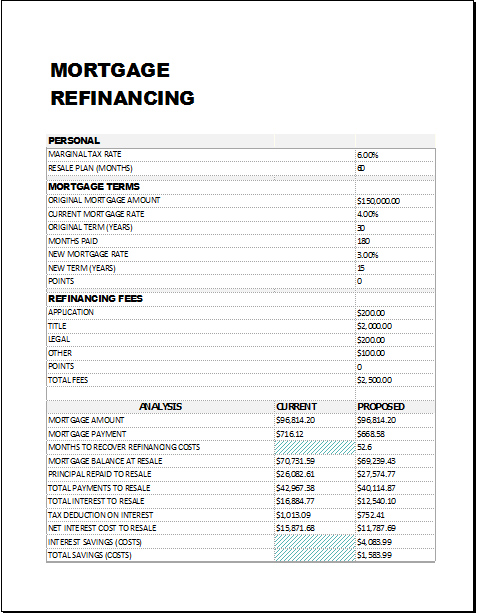

#14

Mortgage Refinance Calculator

The refinance calculator is used to provide help to the person with general information related to the possible benefits which the person may avail of while refinancing his first mortgage. The result which is returned by the calculator should be used by the person as one of many factors in evaluating the options.

The person has to input the information related to the existing mortgage information. The result of the calculator is completely based on these inputs. To receive realistic results, it is very important for the person to input accurate values. The calculator is capable of providing the overview result based on the input you provide to it. The mortgage company uses many types of information to evaluate eligibility.

File 986 KB

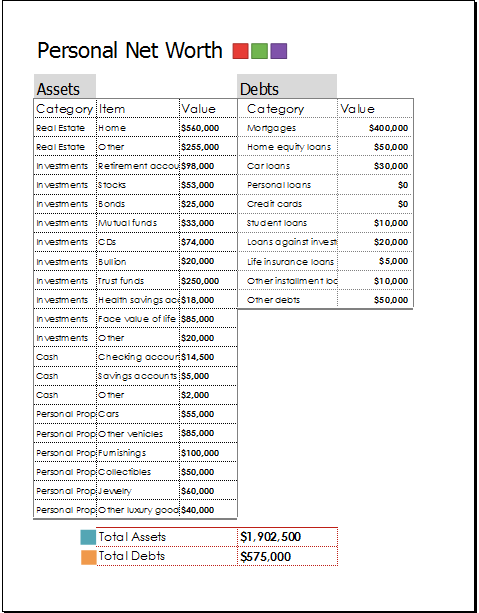

#15

Personal Net Worth Calculator

It is used for checking your net worth position that how much your net worth is stable or not. Many times your net worth will change because your properties make interest or used up problem increase or decrease.

It actually measures your financial health as it mainly says what you have available if you have to sell all of your property after paying all of your debts. You have to aim that your assets were increasing or liabilities were decreasing as it is important for increasing your net worth.

With the help of a personal net worth calculator, you can plan for your tomorrow after knowing your financial health and you may able to know what you own and what you have owed.

File 986 KB

#16

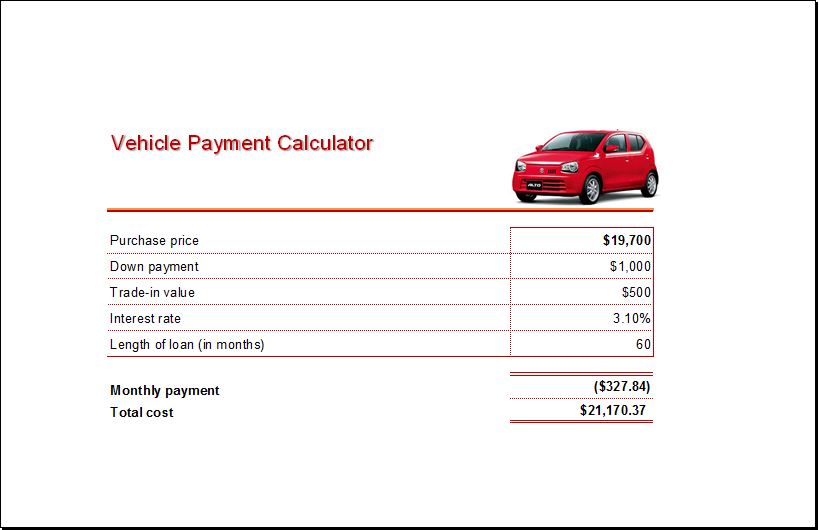

Vehicle Loan Payment Calculator

If you are looking for purchasing a new car then you can get an estimation on the vehicle loan payment calculator and get your monthly figures of the amount. By just entering the vehicle value, interest rate, numbers of the year, loan terms, and trade value and costs you can get a calculation for vehicle loans.

An auto loan is a safe loan that takes interest. This tool helps get an easy and simple way the estimation of payments for a vehicle loan. Your actual payments will change with the help of this calculator. You will get your real rate once you have applied for a loan. Another characteristic of the vehicle loan payment calculator is that it breaks down the monthly payments and shows how much capital you need and how much interest you must pay for this loan.

File 986 KB